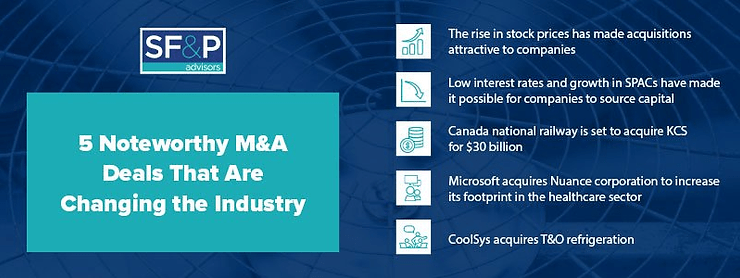

2021 has been a great year for mergers and acquisitions after the slow growth in 2020 due to the coronavirus pandemic. Here are 5 deals that could reshape the industry.

Mergers and acquisitions help businesses expand into new frontiers with ease. Large corporations see this as an attractive and affordable way to exert their dominance. Target companies, on the other hand, can get great deals when they decide to sell. You can always expect hundreds, if not thousands, of M&A deals each year. Things were, however, slow in 2020 as the coronavirus pandemic hit. Many expected that this slump would persist into 2021, but the M&A industry has proven to be resilient even amidst financial setbacks.

The first half of 2021 has seen a stretch of M&A like no other. We are just a little over six months into the year, yet we have seen some record-breaking performance in both the US and abroad.

What are some of the M&A deals that have changed the industry? We’ll explain shortly, but first things first.

Why the frenzy in the M&A industry this year?

A lot of factors are contributing to the flurry of activity in the M&A industry. Stocks continue to perform surprisingly well, which increases the valuation of public firms. In fact, the S&P 500 recently hit its second record high this year on the possibility of a strong economic recovery and company blowout profits. The impact of this has spilled over to the M&A industry in two ways.

First, target companies are eager to sell because they can get an attractive price while stocks are up. Sellers are also open to acquiring more target companies as high stock values have increased their liquidity.

Buyers are also finding it easy to raise capital and acquire companies due to low interest rates. Aside from the large capital reserves that most companies have, near-zero interest rates make it easier to finance deals. Creditors have held up well despite facing challenges during the pandemic. These private lenders continue to offer attractive packages to companies that want to make M&A deals. What’s more? The increase in SPACs has injected fresh capital into the market. SPACs have a two-year period where they should achieve their objectives or return cash to their investors, so this puts pressure on them to speed up transactions.

Noteworthy M&A deals that are changing the game

The year is not yet over, but there have been some significant deals that will impact their respective industry. Some of these deals are still in the pipeline, but all of them are expected to be concluded by the end of the year.

1. Canadian National Railway’s acquisition of Kansas City Southern

Canadian National Railway brokered a US $30 billion acquisition deal with KCS in May this year. This is the biggest M&A deal so far, but it has raised some antitrust issues. If the deal goes through, these combined companies will have more than 20,000 employees and 20,000 miles of railway. It is also expected to churn out about $8.6 billion a year.

There are a couple of interesting things about this acquisition deal. It will form a combined rail network dubbed “Truly North American” that will connect Canada, The United States, and Mexico. It will also be interesting to watch how this deal pans out as the two companies wait for approval.

2. Microsoft’s acquisition of Nuance Corporation

Microsoft made a $20 billion acquisition deal with Nuance Corporation in April. This will see Microsoft expand its reach into the healthcare sector. “But why would this technology behemoth invest in healthcare?” you may ask.

Well, Microsoft has been keen to disrupt specific industries with its cloud offerings. It introduced Microsoft Cloud for Healthcare in 2020 to revolutionize data solutions in the industry. With Nuance’s expertise in voice recognition and machine learning, Microsoft can offer excellent clinical intelligence and cloud services to healthcare providers in the US.

Microsoft estimates that about 77% of hospitals and 55% of physicians in the US use Nuance’s technology solutions. Nuance shareholders got a 23% premium on their share price.

3. CoolSys Acquisition of T&O Refrigeration

In the HVAC world, CoolSys has acquired T&O refrigeration in a bid to expand its reach. CoolSys is a popular engineering, refrigeration, and HVAC company that is part of Ares Management. The firm is one of the largest refrigeration companies operating in the Southeast region. The targeted acquisition of T&O Refrigeration is set to solidify the market presence of CoolSys in the Southeast area.

On the other hand, T&O is a market leader in offering refrigeration services. The firm is based in Fayetteville but has a significant market share in Georgia and Nashville, too. T&O is known for its high-quality service, great customer service, and efficiency.

4. Service Champions Group acquires SWAN

Service champions group also announced acquiring SWAN heating and air conditioning for an undisclosed sum. SWAN heating is a top brand based in Colorado, and this acquisition will help increase the market share of Service Champions Group. The company was founded in 2014 and focuses on offering plumbing and HVAC services to family owners in both Denver and Loveland.

Service Champions’ acquisition of SWAN presents an opportunity for the company to expand its reach in Colorado. This acquisition will also set the foundation for the future expansion of the company into other new frontiers.

5. Gryphon investors acquire Wittichen supply

Another interesting acquisition is the buying of Wittichen by Gryphon Investors. Gryphon is a private equity firm located in San Francisco. The fund focuses on creating partnerships with middle-market firms and growing them to profitability. Wittichen is an established brand that has been in business for more than 100 years since 1914. It has more than 25 locations in Alabama and has been expanding its growth in Florida, as well. The company has a strong culture and a loyal client base that is set to help improve its growth. The financial terms were not disclosed publicly.

We can help you with your HVAC acquisition

2021 has proven to be a fantastic year for mergers and acquisitions. With more deals set to happen before the end of the year, you can also benefit from this acquisition frenzy. Preparing for a merger or acquisition will, however, take up a lot of time and effort. You need a team of professional advisors to help you complete an acquisition successfully. At SF&P advisors, our team of professionals works round the clock to ensure that you have a successful merger or acquisition. Just contact us for a quick consultation.