How to ensure you know exactly what you’re acquiring when you buy a business

Acquiring another business can be a strategic way to grow your business, expand your market share, increase your services offerings, and bring other benefits to your company. But if you want the acquisition to be successful, you need to know exactly what you’re acquiring.

A business can look great from the outside but have problems buried in its accounting records. Similarly, its financial documents can appear sound, but depending on the company’s approach to accounting, they may be hiding the real story. So, how do you find out the truth about your acquisition target? How do you ensure you’re buying something that will truly help your company? By doing thorough due diligence.

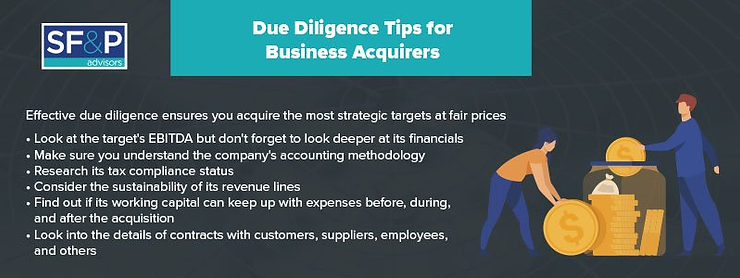

To help you understand what that diligence entails, this guide covers essential due diligence tips for acquirers. Make sure you understand the following elements before acquiring another company.

1. Look at and beyond EBITDA

Typically, a target’s value is based on its earnings before interest, taxes, depreciation, and amortization (EBITDA). Find out this number, but make sure it isn’t artificially inflated by gains from acquisitions or fixed asset sales.

In most cases, business evaluations multiply the EBITDA by a certain factor depending on the strategic value of the company. However, while this metric can be useful, you should also look deeper into the target’s balance sheet to get a better sense of its assets and liabilities compared to other options.

2. Research the target’s accounting policies

A business’s approach to accounting has a significant impact on its financial records. The way the company records financial transactions can make it look viable on paper even if it is struggling and vice versa. While doing your due diligence, find out about the company’s accounting policies in relation to revenue recognition, accounts receivables, and inventory.

3. Determine the company’s tax compliance status

If you acquire a company with outstanding tax liabilities, you may be stuck with the tax bill plus interest and penalties. A long-term lack of compliance could significantly hurt your business’s finances. Before making an offer on an acquisition target, look into the taxes it has paid over the last five years and make sure it is compliant with all reporting and payment obligations.

Also, find out if the company has undergone any government audits and the results of those audits. If the target has outstanding tax liabilities, find out everything you can about payment arrangements, settlements, and extensions to the statute of limitations.

4. Make sure revenue lines are sustainable

Even if the acquisition target appears to be performing well based on an analysis of its financial records, there is no guarantee that the situation will remain consistent. To ensure you’re purchasing a sustainable business, you need to look at its revenue trends during the due diligence process.

Look at the company’s historical revenue streams and determine if they are sustainable. Are the company’s main products and services still in demand or have changing tastes and market forces reduced the viability of these revenue streams? Whenever possible, you should look for recurring revenue sources.

5. Check out working capital

While looking at the company’s financial records, take some time to learn about its relationship with working capital. Find out how its accountants determine its working capital, then make sure that it has enough working capital and other resources on hand to maintain operations through the due diligence and acquisition process.

If a target is not able to maintain operations and meet customer expectations, its reputation will be damaged. It may lose customers or default on contracts with suppliers that would lower its value.

You also need to understand if the company’s current cash flow can support its operations after acquisition. If not, you need to have a sense of how this will impact your own company’s working capital.

6. Consider contracts

The company’s contracts with its customers as well as its suppliers and employees affect short- and long-term sustainability. Do not simply assume that the business’s relationships will remain the same after an acquisition. Instead, take a deep look at the contracts during the due diligence process.

Make sure that the contracts can transfer with the acquisition or be left out of the sale if desired. Elements to consider include control provisions, expiration dates, and policies around price or rate changes.

7. Do due diligence on the customer base

Due diligence should not exclusively focus on financials. You also need to look at a company’s intangible assets, its technology, its employees, and other factors. One area that needs extra attention is customers.

Are the company’s top customers sustainable? Will they stay with you after the acquisition? Keep in mind that an acquisition can affect some customers’ perceptions of the company’s brand. Additionally, you should consider if customers are satisfied and look at warranty issues, service agreements, and other prepaid customer obligations.

The due diligence process is one of the most critical aspects of acquiring another company. If you don’t navigate this process effectively, you may end up overpaying or acquiring a company that doesn’t benefit your business.

To optimize the due diligence process, consider working with a mergers and acquisitions specialist. They can make sure all the necessary research is done so the acquisition turns out exactly how you expect it to.

Contact SF&P Advisors for help with due diligence

At SF&P Advisors, we have handled thousands of mergers and acquisitions for our clients, and we specialize in the HVAC and plumbing industry. We can help with every aspect of the process from due diligence through negotiation and finalization of the transaction.

An acquisition can be a great way to grow your business but only if it’s handled correctly. To get help with the due diligence process as well as the other parts of an acquisition, contact us today.