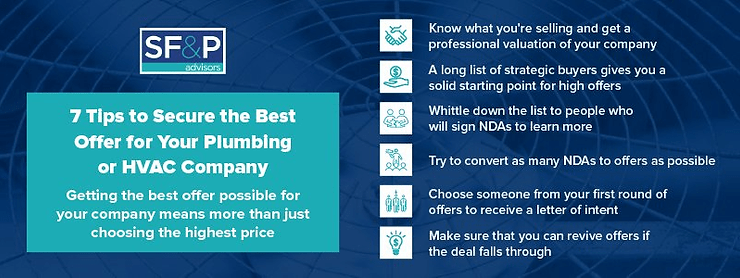

Getting the best offer possible for your company means more than just choosing the highest price

Securing the best offer for your company means more than just angling for the best price. It also entails getting the best deal for your company in relation to your role, your employees’ happiness, the satisfaction of your customers, and the company’s future.

To ensure you get the best offer possible, you need to take steps to boost the value of your company, such as setting up recurring revenue streams, ensuring the company can run without you, and having clear financial records in place. Once those elements are in place, you can start the search for the best offer.

Ideally, you should always hire a mergers and acquisitions specialist to help you through the off process. Whenever possible, you should work with a company that focuses on the plumbing and HVAC industry.

This guide goes over the steps you should take to secure the best offer for your business and how you can get help positioning it for a successful acquisition.

1. Decide what you’re selling

To get the best offer possible for your HVAC or plumbing company, you first need to decide what you’re selling. Incorporated companies, for example, can be sold in asset or share sales. An asset sale is when you sell everything the company owns but not the company itself, while a share sale involves the sale of both the company and its assets. You also need to identify which assets are going to be sold. In addition to tangible assets, you may want to include goodwill, trademarks, or client lists. Having a clear idea of what you’re selling helps you create a more compelling pitch that will attract better offers.

2. Get a business valuation

Once you home in on exactly what you want to sell, you should get a professional estimate of your company’s value. Professionals who deal with the sales of HVAC and plumbing companies every day can help you accurately evaluate your company.

Don’t just pick a number out of thin air, and if you get an offer from someone, remember that they are trying to protect their own interests. Buyers typically want to get the lowest price possible, and you should never rely on a prospective buyer to value your company.

3. Make a market

One of the most basic economic principles is that prices increase as demand increases. The more people who want to buy your business, the better your offer will be. Ideally, you should develop a list of anywhere from 10 to 100 prospective buyers. These should be investors or businesses who have a strategic need to buy your business.

Selling to someone who wants a plumbing or HVAC company just for the fun of it is not likely to lead to that good of an offer. You will get a better offer if your business has the ability to diversify the buyer’s portfolio, expand their market, improve their processes, or provide them with other strategic benefits.

Professional mergers and acquisitions specialists can help you identify prospective buyers because they know the people in the market and what they’re looking for. They work with strategic buyers on a daily basis and have a wide network of contacts who can help them identify high-quality prospects.

4. Have interested acquirers sign non-disclosure agreements

Whittle down your list of prospective acquirers by seeing who wants to sign a non-disclosure agreement (NDA). Keep in mind that only a portion of the investors who sign an NDA will want to take the next step and make an offer, so you need to get several different investors interested.

Hitting the sweet spot can be tricky. You want a low enough number that you can manage all the prospects and their questions. At the same time, you need enough interested parties to generate a competitive offer. For many sellers, the optimal range is 10 to 30 NDAs.

Once prospective buyers have signed an NDA, you can provide them with information about your company. An M&A specialist can help you draft informational packets that showcase the strengths of your company in the best light possible.

5. Gather your first round of offers

At this point, you want to give the people on your NDA list an idea of when you’d like to receive offers and what you want their bids to look like. Again, rather than handling this on your own, you should let someone who is experienced in HVAC and plumbing acquisitions lead the charge. They can more effectively guide prospective buyers toward the type of offers you want to get.

These prospects know that multiple people are bidding for your business, and if they want to stay in the running, they must come up with a compelling offer. If you have a very attractive business, you can expect a high conversion rate between the people who are on your NDA list and the people who make offers, but in most cases, you should aim for at least two offers.

6. Sign a letter of intent

After you choose the best offer, you will sign a letter of intent with the buyer. The letter says that you are interested in their offer and that you will not talk with any other buyers during the due diligence process. You need to handle this part of the deal carefully and efficiently.

Don’t burn bridges with the other prospects. If this deal falls apart, you want to be able to reach out to other investors who put in offers once your no-shop clause expires. Working through this process diligently will help you get the best offer possible. The trick is to start with a large but focused pool of prospects and push them down the funnel until you’re left with the best offer from the most strategic buyer.

7. Contact SF&P for help getting the best offer

You know how to successfully run a plumbing or HVAC business, but we know how to guide a successful acquisition. Contact us at SF&P Advisors today to learn more. We can start with a free evaluation of your company and then help you get the best offer possible with our four-step acquisition process.