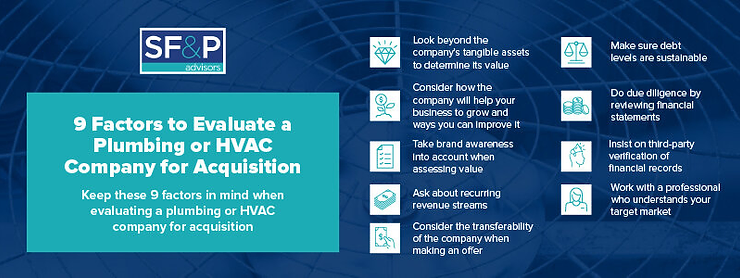

Keep these 9 factors in mind when evaluating a plumbing or HVAC company for acquisition

Acquiring a new company can be an extremely effective way to expand your reach, bring in new customers, and boost your profits, but you need to ensure you’re paying the optimal price. The value of a company may go far beyond the value of its assets and other measurables, which makes pricing acquisitions complicated. These nine factors will help you simplify that calculation.

Evaluating plumbing and HVAC companies for acquisition is challenging because they always come with risks and realistic limitations. Anyone looking to acquire a business should work with a specialist who understands their industry and can help them evaluate the target and negotiate the deal.

This guide explains nine of the most important factors you need to take into account when evaluating a plumbing or HVAC company for acquisition.

1. Opportunity for growth Look at how the target company can improve your portfolio or help your existing business to grow. Will the target help you add additional services? Expand into new territories? Improve your brand image? Will the acquisitions help you gain skills or technologies to enhance your offerings or grow in other ways?

Also, consider how you can help the target company grow. Its current owners may be missing out on opportunities to enhance profits or expand the company that represent untapped potential you can leverage for improvement. Maybe you can instantly reduce expenses and improve the profit margin and cash flow of the target company, for example.

2. Brand awareness Brand awareness plays a significant role in the value of a company. A competitor with better prices or more HVAC and plumbing services could easily sweep through the area and assume the business’s market share if it doesn’t have brand recognition. The company’s brand awareness needs to go beyond its existing customer base. It needs to have a presence in the minds of other people in the area.

3. Recurring revenue streams Customer acquisition costs tend to be high in businesses with few repeat customers, and you need to take this into account when evaluating plumbing and HVAC companies for acquisition. The subscription-based model of pricing may not be the norm in this industry, but it is becoming increasingly common with service plans.

Targets that have a lot of residential and commercial clients signed up for annual service plans have built-in recurring revenue. Repeat customers also offer value, especially if you believe you can bring them deeper into the fold by implementing subscription-based pricing or other recurring revenue models once the acquisition is complete.

4. Transferability HVAC and plumbing companies with documented, standard operating procedures tend to transfer more easily than those without standardized workflows. The owner’s role in the company also affects its transferability. Companies that rely heavily on the owner’s skill sets and knowledge base don’t tend to transfer as easily.

Find out what the owner does. How much do they work? Are operations sustainable if they step away from the helm? You don’t necessarily want to be strapped to everyday operations, and if the company’s success hinges on its owner’s efforts, you may be forced to work in the business instead of on the business.

5. Debt High levels of debt may make a target acquisition unsustainable. You don’t want to buy a company that cannot generate enough cash to cover its liabilities or that is on the brink of bankruptcy.

Debt can also represent an opportunity, and it can be leveraged to obtain a better price on the company. The best opportunity with debt tends to be when the target company has high-interest debt that you can refinance at lower rates. This maneuver instantly lowers the company’s short-term liabilities and helps improve your cash flow after acquisition.

6. Financial documents Make sure you do adequate due diligence to understand the target company’s financial situation. You need to see balance sheets and profit and loss statements for at least the last five years. You should also look at cash flow reports and accounts receivables to get a sense of how the money flows in and out of the company.

Companies may not always have accurate internal reports. To verify the information on their accounting statements, you should look at their tax returns for income, unemployment, and sales tax over the same time period.

7. Third-party verification Never just work with a seller’s estimates of a company’s value or rely exclusively on financial statements provided by a seller. Make sure you obtain third-party verification of the company’s financial records before putting in an offer to buy. Audited financial statements reduce your risk by allowing you to verify the company’s financial situation.

8. Business risks Business is fraught with risks, and acquiring a new business always comes with some risks. You need to decide if the risks are worth the potential for reward. Perform a risk analysis to determine if you have the capacity or the interest to withstand the target company’s risks.

A SWOT analysis, for example, looks at a target’s strengths, weaknesses, opportunities, and threats. You should always perform this type of analysis when acquiring an HVAC or plumbing business.

9. Get help evaluating companies for acquisition Acquiring a business is an exciting opportunity, but you need to tread carefully to ensure you pay the right price for the company you are acquiring. There are no one-size-fits-all solutions in HVAC and plumbing mergers and acquisitions, and the right company for your needs may not be the right company for someone else.

SF&P Advisors focuses exclusively on mergers and acquisitions in the HVAC and plumbing industry, and we can help you identify targets, assess their value, and determine if they are the right fit for you. Contact us at SF&P Advisors today to learn more about how our expertise can guide your next acquisition.