How businesses combine through consolidations and what it means for the owners and other stakeholders

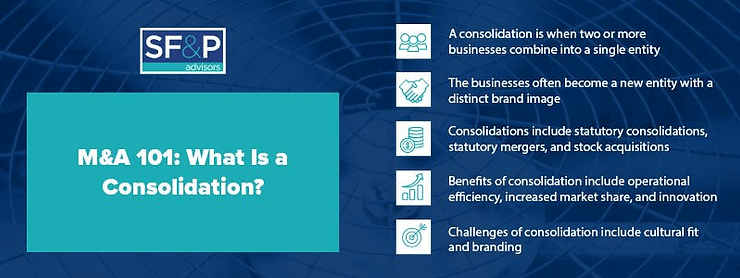

Also called an amalgamation, a consolidation is when two or more different businesses combine into a single organization. When handled correctly, consolidations improve operational efficiency and increase profits, but they are not a guaranteed recipe for success and can come with downfalls.

If you’re thinking about selling your company, acquiring another company, or merging with another entity, you need to understand the different options. To give you insights on where to start, this guide explains consolidation and takes a look at its main advantages and disadvantages.

Why businesses decide to consolidate

Businesses decide to consolidate for a variety of reasons, but the most popular reason is the potential for increased market share and long-term savings. By combining two or more entities into one, businesses reduce operational inefficiencies while also gaining access to new markets.

Here’s a quick example: Imagine a small town that has two competing HVAC companies. ABC HVAC typically handles the business on the east side of town, while XYZ HVAC handles the business on the west side. By consolidating, these companies eliminate the competition and take over the whole market share of the area.

Once they consolidate, the two companies are able to share administrative staff, and they save money by letting some of their existing staff go. This is just one example of the type of redundancy that can be eliminated through consolidation.

Benefits of consolidation

Again, the main benefit of consolidation is increased operational efficiency, but that doesn’t just mean eliminating unnecessary staff members. It can also mean sharing assets, office space, supplies, and more.

Additionally, as businesses increase their market share and expand their customer base, they often get access to better prices from vendors because they are able to order larger quantities of supplies at volume discounts.

Consolidated businesses may also find it easier to obtain financing at attractive rates. Small businesses have much lower loan approval rates than big companies. By consolidating, businesses bring in more revenue and appear more stable — traits favored by investors and lenders.

After consolidation, the combined efforts of the employees from both organizations can increase the innovation in the organization in relation to products, services, and workflows. Consolidation can also improve the geographical reach of a company and its product lineup.

Challenges of consolidation

For consolidations to move forward, the shareholders must approve the arrangement. Businesses need to ensure they handle the process in a way that accounts for the needs and concerns of all stakeholders.

Businesses also need to make a plan to address redundancies. If needed, layoffs must be handled gently, and businesses also need to plan how they are going to deal with redundant assets such as excess equipment.

There are many intangible consolidation challenges, as well, such as cultural clashes between the two companies. Consolidations tend to work better if the companies have similar cultures. If one company has a very authoritarian management style, for example, while another tends to use a decentralized power system, they may struggle to work together.

Some consolidations keep the brand image of the larger company, but many create a new entity. That requires extensive branding and marketing efforts. HVAC and plumbing companies, for example, may need to revamp physical assets, such as vehicles and signage, but they will also need to alter their advertising and update their websites.

Types of consolidation

There are several different types of consolidation, and some of these options overlap with mergers. Here is a brief overview of the main types of consolidations most businesses use.

- Statutory consolidation: Statutory consolidation is when two businesses are combined into a new entity. The original companies cease to exist, and together, they create a new, larger corporation. To continue with the example above, imagine that ABC HVAC and XYZ HVAC combine to become QRS HVAC.

- Statutory merger: With this type of consolidation, one business acquires another business, liquidates its assets, and stops its operations. Then, the acquiring company continues operating and typically fills in the market share gap left by the other company. For example, ABC HVAC acquires XYZ HVAC. ABC sells all of XYZ’s assets and takes over its contracts. XYZ ceases to exist, and ABC takes over the HVAC market for the whole town.

- Stock acquisition: This type of consolidation occurs when one company buys over 50% of another company’s stocks. Both companies continue to exist, but the acquiring company has a controlling interest in the other company.

- Variable interest entities: Variable interest entities are a type of special purpose vehicle, and in these types of consolidations, the acquiring entity buys a controlling interest in a company by purchasing over half of its stocks, but it does not have any voting rights in the company. Typically, this is a passive investment.

The right consolidation option depends on your business’s current structure as well as your plans for the future. When you work with an M&A specialist, they can help you identify the best way forward for your situation.

Consolidations often happen in response to market saturation, which is when there is too much supply of a product or service in an industry. To again return to the ABC and XYZ HVAC companies, imagine that both businesses are struggling because the town is simply too small to require multiple HVAC companies. To avoid an intense battle, these companies decide to survive by consolidating forces.

Market maturity can also drive consolidations. Typically, this involves large companies buying small successful companies, while letting less successful small companies go out of business. At the end of the process, there are only a few major companies left.

Contact SF&P Advisors to talk about consolidation today

At SF&P Advisors, we guide HVAC and plumbing companies through mergers, acquisitions, and consolidations. Thinking about consolidating with another company or want to get offers for your company? Then, contact us today. We can start with a free evaluation and help you decide the next steps forward.