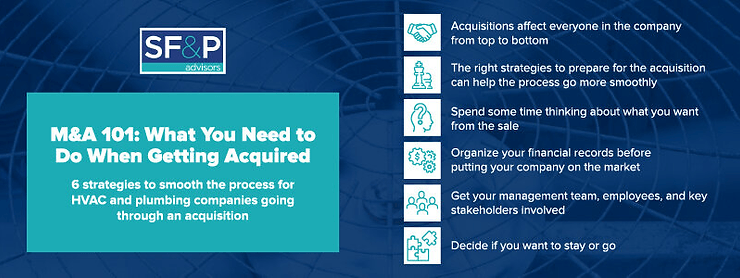

6 strategies to smooth the process for HVAC and plumbing companies going through an acquisition

Selling your HVAC or plumbing company to another entity allows you to cash in on your life’s work, but the process can be scary and anxiety-inducing, especially if you don’t know what to expect. Acquisitions can also be disruptive to your managers and employees. The right strategies, however, will allow the acquisition to move forward as smoothly, easily, and, most importantly, profitably as possible.

This guide is designed to help you through the acquisition process when you’re on the seller’s side. It explains the steps you can take to prepare yourself, your employees, your clients, and other stakeholders for the acquisition, and it looks at the decisions you need to make before, during, and after the acquisition process.

1. Think about your goals Why do you want to sell your company? What do you want to gain from the acquisition? You should have considered these questions before you put your company on the market, but re-evaluate them now to make sure you have a clear idea of how you want the acquisition to play out.

You might just want to walk away with a check, but for many business owners, mergers and acquisitions are more complicated. Think about how the acquisition will affect your career, your business’s brand, and the future of your company.

Understanding your goals and your reasons for selling will help guide you toward the best outcomes for the acquisition.

2. Organize your financials Disorganized paperwork can slow down the acquisition process, and it can also damage your ability to get a fair price when you sell your plumbing or HVAC company. Take some time to get your financial house in order.

Make sure you have well-organized accounting records and that your tax returns have been filed. Consider what you would look for if you wanted to buy a company and think about how others are going to view your business when they do their due diligence.

3. Get the management team involved Your management team plays a significant role in the success and value of your business. Be open with them that you plan to sell and talk with the acquiring company about its plans for your management team.

Let your managers know about the roles they may play in the future of the company once it has been acquired, and if the new company is bringing in their own management team, let your managers know so they can start looking for new opportunities. Get your managers involved in the integration process in a way that highlights their strengths if you anticipate that they will continue to be with the company after the acquisition. This can help to highlight their strengths and innovation to the acquiring company.

4. Keep key stakeholders updated Your key stakeholders should understand that the acquisition is happening. Don’t surprise them with your decision. Be transparent about the process and get their support. You don’t want to face a last-minute surprise that slows down or derails the sale.

Be sure to also walk through the changes with major partners and clients. The acquirer may want some reassurance that they are not going to lose their client base right after acquiring you. Satisfied clients can even serve as references to potential acquirers, so you want to have them on board with the process.

5. Prepare employees for the acquisition About 30% of employees are made redundant after a merger or an acquisition, and even if they stay on board, they have to deal with changes in management styles and workflows. Be proactive about preparing your employees for the acquisition. Let them know if they might lose their jobs and what to expect if they continue working with the company.

Uncertainty is often the most stressful part of the acquisition process for employees, and when employees are stressed, they lose focus and productivity drops. Being transparent doesn’t just help your employees through the process, it also safeguards your business’s productivity and helps the acquisition go forward as smoothly as possible.

6. Decide if you want to stay or go Your presence may help to smooth the transition period for the acquiring company. This is especially true for HVAC or plumbing companies that are complex, and you may need to stay on to train the new owners or management team in your workflows. You may also want to stay to help the acquiring business build relationships with key vendors, clients, and other stakeholders.

Offering to stay can sometimes even enhance the value of the sale. You may be able to garner a higher sale price if the acquiring company knows that you’ll be staying on to guide the transition process. You may be able to continue working for a salary or as an independent consultant, and the arrangement can be full-time or on a part-time basis. Many owners, in contrast, opt to step away from the company completely after an acquisition. The sale of their company signals the end of their career and the beginning of retirement or the chance to launch a new opportunity. If that’s your plan, make sure that is clear and other plans are in place for a smooth transition.

Let SF&P guide you through the acquisition We specialize in mergers and acquisitions for plumbing and HVAC companies, and our four-step acquisition process helps to ensure your sale moves as swiftly and efficiently as possible. Contact us at SF&P Advisors to learn more.