Many factors are aligning to make 2021 a great year for M&A deals. See where the trends are leading and how they might impact your plans.

M&A activity and deals saw a sharp rise in the final half of 2020. Frankly, it would have been difficult to predict the rebound of M&A deals at a time when the coronavirus pandemic was ravaging capital markets. Within a short period, many businesses slowed down their operations and global supply chains were interrupted. This made it difficult to carry out M&A deals as companies were redirecting funds and their focus to other pressing issues.

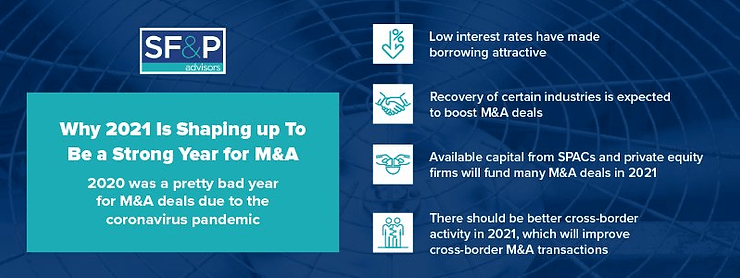

That said, 2021 is proving to be one of the best years for M&A deals as several records are being broken. Here are some of the reasons why 2021 is shaping up to be a strong year for M&A.

A brief review of the year 2020

One major activity that affected businesses in 2020 was the coronavirus pandemic. Thousands, if not hundreds of thousands, of companies scaled down their operations or simply closed shop. At the same time, many employees were furloughed or retrenched as businesses changed their operations. This was mostly done in a bid to survive the impact of the coronavirus. The disruption of global supply chains and plummeting demand for the oil & gas industry only made things worse.

What was the impact of the pandemic on M&A? There was a reduced appetite of buyers and low valuation offers from sellers, which made deal-making quite difficult. The M&A sector has been through and survived a number of financial crises in the past, such as the recession in 2008 and the dot-com bubble burst in 2001. However, things proved to be quite difficult in 2020 as there were other factors affecting mergers and acquisition deals.

Many companies have adopted remote working for their employees and the fall in cross-border transactions has changed the rules of the game. Deal financing became scarce and there arose a need to change how companies carried out due diligence. Regulatory issues also arose regarding the use of SPACs, which impacted the financing of M&As. With a focus on maximizing liquidity and transitioning to the post-pandemic world, several firms shelved any M&A plans that they had.

4 reasons why 2021 will be a great year for M&A

Although 2020 proved to be a difficult year for M&A and other business sectors, 2021 is proving to be a different year. These are some of the reasons why companies will witness a better trend in M&A over this coming year.

1. Low interest rates

One of the main reasons why companies saw an improvement in M&A in the second half of the year is because of low interest rates. These rates have made it possible for companies to access capital without the risk of paying high interest.

Access to capital and the opening up of the global economic markets have given businesses the confidence to allocate funds in other areas. Since these firms are looking for ways to expand and grow, M&A is still proving to be one of the attractive ways to achieve this. High performance of the equity market from last year has also made it lucrative for businesses to conduct stock-for-stock transactions. This trend is likely to continue if the equity market continues its stellar performance.

2. The economic recovery of various sectors post-COVID

A couple of business sectors were highly affected by the coronavirus pandemic. In fact, most of the M&A deals in the previous year were in industries that were sheltered from the impact of the coronavirus pandemic. This means that industries such as tech, healthcare, and financial services witnessed more deals in M&A. Other industries, such as real estate and energy, took a beating with most companies opting to pause any pending M&A deals.

Both buyers and sellers found it difficult to reach a consensus on valuation since no one knew how 2021 would pan out. With an increase in the number of people receiving the vaccine, it is likely that the sectors impacted by COVID will now rebound and more deals will be seen.

3. Improvement of cross-border activity

International M&A witnessed a decline since 2020 due to various reasons. First, the pandemic made it almost impossible for cross-border operations to work smoothly. Most countries placed limits on air travel, which led to a decline in cross-border transactions. This also made it difficult to do due diligence on companies that were outside the US. Due diligence is a crucial aspect of any M&A deal, especially if it involves large amounts of money.

The withdrawal of the UK from the EU also brought about some geopolitical tensions. Companies were unable to conduct cross-border M&A as there was a lot of uncertainty about the regulations involved. We can expect an improvement in cross-border activity owing to the global vaccination drive that may lead to the resumption of business travel.

4. Available capital from special purpose acquisition vehicles (SPACs)

SPACs are special purpose companies created with the sole intention of making private companies public. These firms have a definite period where they should have completed their transactions, which prompts them to finalize deals urgently. With 118 SPAC IPOs in the last year that raised more than $40bn, the use of SPACs is predicted to rise this year.

These companies can quickly raise funds and will contribute significantly to M&A deals in 2021. Private equity firms also continue to invest attractive sums of money in M&A deals. Investments from private equity have been on the rise and this trend should continue in 2021.

Get professional help in your M&A deal

Business has been quite difficult for many companies in the last year. The economic environment is, however, improving and businesses need to see how they can grow into profitable entities. 2021 is expected to be a better year for M&A as more companies seek to grow.

Completing a merger or an acquisition can be a complex process, especially if you do not get the right guidance. With typical M&A deals involving large amounts of cash, it is prudent to invest in professionals who will walk with you every step of the way. Luckily, we have a team of professionals that are ready to help you seek attractive growth opportunities. Simply contact us for a quick consultation.