Tips for minimizing antitrust risks during mergers and acquisitions

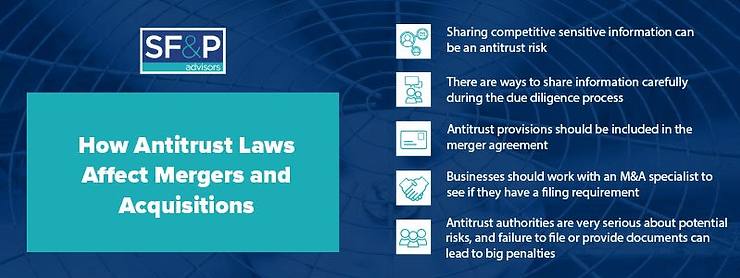

Antitrust laws encourage competition by limiting the power of any single firm, and they apply to mergers and acquisitions to ensure that companies aren’t joining forces to form monopolies or gain an unfair concentration of market power. These rules are designed to protect consumers, but they can present challenges for businesses. If you’re thinking about a merger or acquisition, you need to understand how these laws may affect the transaction.

Antitrust laws often govern activities that seem harmless from the business owner’s perspective, but breaking these laws can lead to fines or even disrupt your ability to successfully complete the transaction. This guide explains why you need to be aware of antitrust laws during the M&A process.

Understanding the rules about competitive sensitive information

During the due diligence process, you want to learn as much about the company you’re acquiring or merging with as possible. But if you are competitors, sharing competitively sensitive information (CSA) can present an antitrust risk.

The Sherman Act prohibits contracts, combinations, or conspiracies that unreasonably restrict trade. Competitors (even if they plan to merge) are not allowed to share CSI such as price information, confidential customer-specific data, detailed research and development, product forecasts, or other forward-looking market activities.

Even the due diligence process does not give competing businesses the right to share this information freely. The rules are designed to prevent companies from engaging in unfair business practices such as sharing pricing details about rebates, discounts, and margins in an attempt to fix prices and drive other companies out of business.

Share information carefully during due diligence

Companies that plan to merge can share some information freely, such as balance sheets, aggregated customer information, and operational systems. They may also be able to share CSI related to costs and prices on an aggregated or historic level. In both cases, they need to tread carefully and consult with an M&A specialist who understands the intersection between antitrust laws and mergers and acquisitions.

To limit antitrust risks without reducing the ability to share information, businesses should share CSI with outside counsel or third parties who are guiding the transaction. This allows representatives of both companies to assess critical data without having a direct exchange of CSI between competitors.

Alternatively, businesses may want to establish a “clean team.” This is a group of individuals in the company that can evaluate the CSI of a target company without it providing any value to their organization. To make this possible, the clean team typically needs to be absolved of their usual responsibilities for a certain period of time, and ideally, you should create a paper or digital trail that shows the information was only used for the purpose of analyzing the viability of the acquisition.

Including antitrust provisions in the merger agreement

To protect everyone involved, the merger agreement should contain antitrust provisions. To give you a sense of what this means, here are some commonly used provisions:

- Hell or high water provisions: Requires both parties to use all their best efforts to get the deal completed, including going through the regulatory review process and dealing with litigation brought forward by antitrust authorities.

- Divestiture provisions: These require buyers to divest assets as needed to soothe concerns from antitrust regulators.

- Termination fee provisions: These allow either party to stop the transaction because of antitrust regulation or litigation concerns.

- Timing provisions: These name a date by which the deal must be closed so antitrust issues do not drag it out indefinitely, potentially causing harm to one or both of the parties.

These provisions are just examples of the types of provisions you may want to include in your agreement, and these particular examples cannot all be used together. An M&A specialist can help you identify the optimal provisions based on your situation.

Identifying if you must meet filing obligations

Some mergers and acquisitions can trigger filing obligations based on the size of the parties and the value of the transaction. Again, an M&A specialist can help you assess if your transaction is likely to results in a Hart-Scott-Rodino (HSR) filing obligation, and if so, you need to pay filing fees and provide certain requested documents to the antitrust authorities.

Violating these types of rules can lead to fines of $40,0000 per day, and failure to provide requested documents can lead to even more severe penalties. For example, the Department of Justice once fined a company over a half-million dollars for failure to provide requested documents, even though it ultimately decided the transaction showed no antitrust risks.

Communicate carefully if you need to make a merger filing

If the transaction requires a merger filing, the reviewing bodies may want to look at all kinds of correspondence between the teams of both businesses. Make sure that you and everyone involved with the merger or acquisition are very careful about the information they include in emails, voicemails, instant messages, handwritten notes, and other types of correspondence.

In particular, you should be factual and serious while communicating. Jokes or exaggerations could be misinterpreted, and in the past, the US government has looked at all kinds of communication documents when filing complaints or evaluating the potential harm of a transaction.

Once you finalize the deal, you still need to be careful. Antitrust regulators don’t consider the deal complete until they review the transaction, and while you wait, you need to continue to operate as separate entities. During this time, you may advertise the benefits of your merger, but maintain separate operations. Not sharing CSI is key until you’ve passed the review.

Contact SF&P Advisors today

At SF&P Advisors, we help guide companies through the M&A process, and we specialize in the HVAC and plumbing industry. To get help dealing with the unique risks and challenges of the M&A space, contact us today. We can offer you a free valuation of your company and extensive support through the M&A process.