Your employees are the most important asset in your company. Learn how you can walk with them through an acquisition.

Mergers and Acquisitions often seem like a walk in the park, especially if you have the right professional advisors by your side. Founders prefer M&A due to the numerous benefits that they offer. Companies engaging in M&A have the advantage of pooling resources, which allows them to grow in size expeditiously. They also get access to frontier markets and grow their visibility.

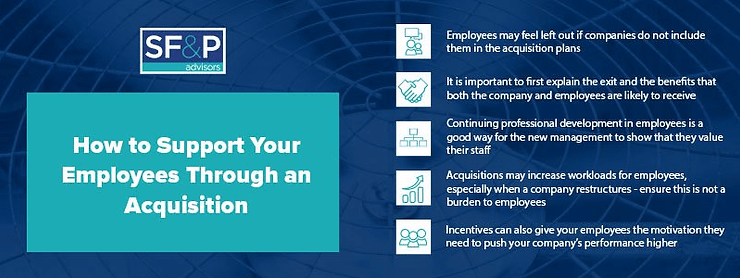

Acquisitions make a lot of business sense and are great for both founders and investors. Employees, on the other hand, may feel left out, especially if their fate hangs in the balance. Workplace culture may change, making existing employees uncomfortable. At the same time, the acquiring company often takes over management and existing workplace teams are dissolved.

When such things occur in an organization, employees can feel isolated as they try to adapt to the new culture. They may also take a step back from prioritizing the organization or proposing new changes. Luckily, you can easily lead your employees through an acquisition if you have the right advisors. Taking the right steps will ensure you do not have to go through another tedious recruitment process.

Why you should retain your employees in an M&A

Let’s face it, employees are an integral part of your business, and any human resource challenges can negatively impact your business. Recruitment takes time, and it may be impossible to get talented staff once you let your previous employees go.

Here are a couple of reasons why you should always strive to retain your employees in an M&A:

- Retaining employees reduces the turnover rate, which would be detrimental to the performance of the acquired firm

- Boosts the morale of existing employees, who may fear losing their jobs upon the announcement of a merger

- Helps save the costs you would have to incur when training new employees

- Saves time that you would otherwise have to spend on recruiting, training, and incentivizing new employees

- Allows everyone in the organization to focus on their core activities, which boosts performance

Ways to support your employees in a merger

It is not uncommon for the management of a merging organization to feel pressure during a merger or an acquisition. This often trickles down to employees, who get anxious about their prospects under the new owners. Here are five ways to support employees during a merger or acquisition.

1. Explain the exit

Acquiring companies will usually have to restructure or downsize after an M&A transaction. This is done to take advantage of the operational synergies of the two firms. Many original executives tend to leave immediately after acquisition. About one-third of employees leave involuntarily while another third leave when facing alienation from the new firm.

The effects of employee turnover after a merger are profound. It reduces management stability, puts a strain on communication, and impacts company culture. New hires, even on the management side, are likely to find a fractured organization.

An easy way to deal with these problems is to explain the exit. Current managers should explain why a merger or acquisition is taking place. They should also outline the benefits that the company and employees should expect.

2. Manage the existing professional development

Several organizations discontinue their professional and learning development upon the news of a potential merger. This can be done to not only cut costs but also improve the company’s bottom line, but the cost is far outweighed by the benefits a company gets by improving employee learning.

Aside from this, training that seeks to enhance job performance presents another benefit. It reinforces the belief that the new management values its employees by helping improve their skills.

3. Watch the employee workloads

One unforeseen impact of M&A is that employees often have to take on additional work. This is especially true in cases where a company undergoes restructuring: Most employees get additional roles as others are retrenched.

Organizations going through a merger should have an open discussion on the new workloads expected of their employees. They should also support them in their new roles by giving them the right mix of knowledge and skills.

4. Assess how performance is measured

A good performance management process should help an organization identify and manage its talent. It should also ensure that managers can properly evaluate the working competency of employees. Managers need to understand the importance of performance management and invest both time and effort into the process.

One way for managers to do this is to offer formal feedback to their employees. They can also mentor and have regular discussions about performance with them.

5. Create attractive incentives

Employee morale is often affected during mergers and acquisitions. Having incentives can be a great way to boost motivation at the workplace. A good incentive program is key to making even new employees feel part of your organization.

Bonuses based on performance, and even promotions, can be a nice way to acknowledge the services that your employees offer. It will also motivate them to be better at their work.

SF&P Advisors can help you with employee support during your merger

Employees make up a significant part of your organization’s value and should be treated in a befitting manner after a merger or acquisition. One way to ensure this is done properly is to have the right team of advisors by your side. SF&P Advisors has helped hundreds of companies with their mergers and acquisitions. You can also benefit from the knowledge and experience our advisors bring to the table. Contact us today for a quick consultation.