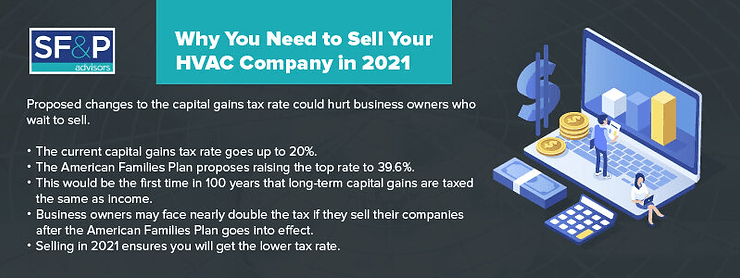

Proposed changes to the capital gains tax rate could hurt business owners who wait to sell

Tax code changes are on the horizon, and if you are thinking about selling your HVAC business, you should act now rather than waiting. The Biden administration has suggested sweeping tax changes, and one of the proposals may substantially increase the capital gains tax rate for top earners, like those who’ve sold a business.

The tax change is still just a proposal, but it is likely to pass for the next tax year, and that could nearly double the tax rate on capital gains earned from selling your HVAC business. This tax increase essentially decreases your potential profits by 20%, putting a significant amount of the wealth you worked your whole life to build into the hands of the government.

This guide looks at the capital gains tax rate changes proposed in the $1.8 trillion American Families Plan, and it explains how this shift will affect capital gains tax for anyone who sells a business if the proposal becomes law. Keep reading to find out why you may need to sell your business sooner, rather than later.

What is capital gains tax? Capital gains tax is assessed on profits earned from the sale of investments. Here is a simple example: If you buy a stock for $1000 and sell it for $3000, you have a $2000 capital gain and must pay capital gains tax on that amount. There are both short-term and long-term gains, and they have different tax rates.

Short-term capital gains refer to investments that have been sold less than a year after the investor purchases them, and investors face their regular income tax rate on these gains. Long-term gains, in contrast, refer to profits made from investments held longer than a year, and these gains are subject to the capital gains rate.

The capital gains tax rate has traditionally been much lower than income tax to encourage investment, but the proposed increase may disrupt this reality.

What capital gains tax applies to the sale of HVAC companies? You face the long-term capital gains tax rate when you sell an HVAC company because, in almost all cases, these companies have been owned for a lot longer than a year. Most people spend decades of their lives building up their HVAC businesses.

How much is capital gains tax? There are currently three capital gains tax rates for long-term investments: 0%, 15%, and 20%. People with incomes under $40,000 pay 0% on long-term capital gains, incomes between $40,001 and $441,450 face a rate of 15%, and earners over that threshold pay the 20% rate.

The top income tax rate, in contrast, is 37%. The current set-up offers top earners significant savings when they sell an investment. Say someone earns a capital gain of $1 million when they sell their HVAC company. The top capital gains rate right now means that they just pay $200,000 in capital gains tax. They would face a $370,000 tax bill if they had to pay their income tax rate on those gains.

How will the proposed capital gains tax affect sales of HVAC companies? The proposed capital gains tax increase threatens to raise this tax bill even more. The American Families Plan proposes raising the top marginal income tax rate to 39.6% and bringing the capital gains rate up along with it. The last time capital gains were taxed at the same rate as income was in 1921.

This shift nearly doubles the top rate for capital gains. To return to the above example, the capital gains tax on $1 million would increase from $200,000 to $396,000. This is nearly double the rate and nearly half of the gain! People who sell their businesses now under the current rates will walk away with much more money than people who wait until these tax changes become reality.

Why should HVAC owners be proactive about selling before the increase? You have worked hard building your HVAC company, and if you decide to sell, you don’t want to give nearly half of the profits to the government. These funds should go to yourself and your family.

This American Families proposal is not set in stone, and it needs to go through several steps before it can become law. Keep in mind, however, that most administrations bring in tax reform, and the Biden administration will likely follow suit. Democrat control of both the House and the Senate will make it easier for the Democratic administration to move forward with its proposals. The changes are likely to take effect for the 2022 tax year if they are passed into law in 2021.

How can you reduce capital gains on the sale of an HVAC company? There are several steps you can take to reduce capital gains. You need to ensure that your basis is as high as possible. Your basis refers to the amount that you paid to acquire the company, and it gets subtracted from the sale price you earn from your buyer. The remaining amount is your capital gain, so increasing your basis reduces your capital gains.

You can add capital improvements as well as a few other expenses to your basis. Ideally, you should work with a professional to ensure you report the highest basis possible. You also need to sell before these changes become law. There are hardly any tax strategies that could help to mitigate this significant jump in tax rates.

Get help with your HVAC sale from SF&P Advisors We specialize in mergers and acquisitions for HVAC companies, and we can help you sell your company before the proposed tax changes take effect. Contact us today at SF&P Advisors, and let our CPAs and specialists guide you through the process as effectively and intelligently as possible. We help our clients get the best value possible for their life’s work.